Athens Tax Preparer Admits to Filing $3 Million in Fraudulent Returns, Faces Up to 30 Years in Prison

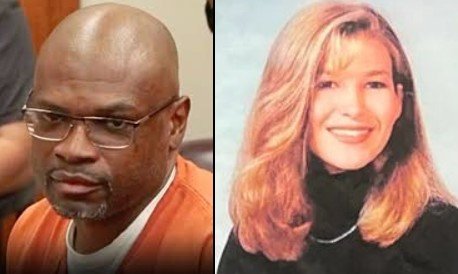

Jessica Crawford, 33, of Athens, Georgia, pleaded guilty on November 22, 2024, to charges of wire fraud and aiding in the preparation of false income tax returns, admitting to filing fraudulent returns that caused the IRS to lose over $3 million. Crawford faces a maximum sentence of 30 years in prison, five years of supervised release, and a $1 million fine. Sentencing is scheduled for March 19, 2025, before U.S. District Judge Tilman E. “Tripp” Self, III.

According to court documents, Crawford operated Crawford Tax Services and was involved in a multi-state fraud scheme related to Pandemic Unemployment Assistance (PUA) during the COVID-19 pandemic. She filed fraudulent claims for unemployment benefits on behalf of individuals who fabricated businesses or submitted false information. Crawford received a percentage of the benefits, which were illegally obtained.

The scheme was uncovered as part of a broader investigation by the FBI and IRS-Criminal Investigations (IRS-CI). During the investigation, agents found text messages between Crawford and individuals involved in the fraudulent PUA claims. In one case, an undercover IRS agent met with Crawford to have taxes prepared. Crawford suggested falsifying a Schedule C for a business the agent claimed to have. Despite no actual business expenses or income, Crawford created a fake landscaping business on the agent’s tax return, resulting in a fraudulent claim for a $12,359 refund.

Additionally, a review of 1,261 tax returns filed by Crawford in 2020 and 2021 revealed widespread fraudulent activity. The IRS identified that Crawford submitted returns with falsified deductions, including bogus claims for sick leave, family leave, and tax credits for dependent care, leading to more than $3 million in losses.

FBI Special Agent in Charge Sean Burke and IRS-CI Special Agent in Charge Demetrius Hardeman condemned Crawford’s actions, emphasizing the harm caused to taxpayers and the legal system. The case is being prosecuted by Assistant U.S. Attorney Robert McCullers and Criminal Chief Leah E. McEwen.

This case serves as a reminder to taxpayers to choose tax preparers carefully and verify the accuracy of the information submitted on their returns.