Augusta Pair Face Prison for Running ‘Ghost’ Tax Prep Schemes That Cost Treasury Over $1.5M

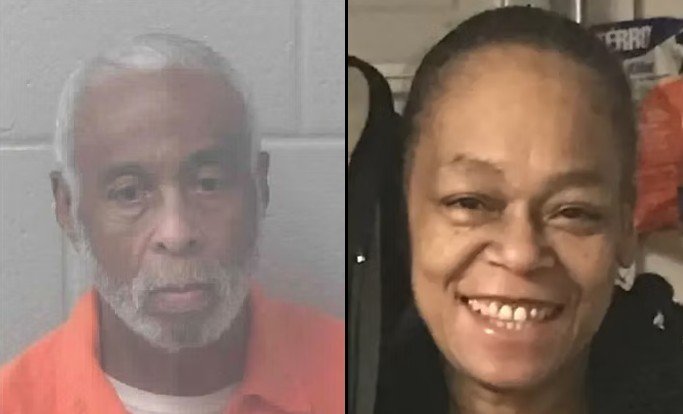

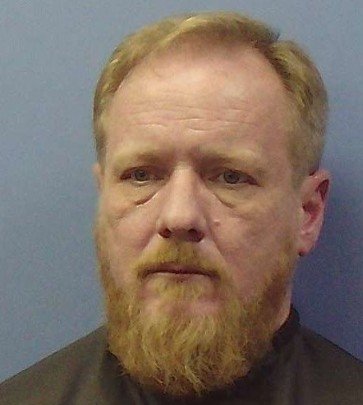

A man and woman who operated separate “ghost” tax preparation businesses in Augusta, Georgia, are awaiting sentencing after pleading guilty to federal tax fraud charges that resulted in more than $1.5 million in fraudulent refunds.

Allen Brown, 41, of Augusta, pled guilty to conspiracy to commit wire fraud and faces up to 20 years in prison, along with supervised release, restitution, and fines, according to Acting U.S. Attorney Tara M. Lyons. Brown’s operation was active during 2022 and 2023 and operated out of multiple locations in Augusta, including a commercial suite at 1850 Gordon Highway, a church, and his own residence.

According to the plea agreement, Brown worked as a “ghost” preparer—someone who prepares tax returns for pay but fails to sign them as required by the IRS. He fabricated income, claimed false deductions and credits, and charged clients a percentage of the fraudulent refund amount. Clients were not given copies of their returns or a chance to review them.

Brown and his co-conspirators submitted 63 false federal income tax returns, generating $1,003,631 in fraudulent refunds. The scheme offered clients two options: a “Standard” return yielding a fake refund of $2,000–$9,000, and an “I’m Not Scared” option that generated fake refunds of $14,000–$30,000. For the latter, Brown instructed preparers to falsely claim Fuel Tax Credits and report fictitious income and expenses. He charged a 10% fee on each refund obtained.

In a separate but related case, Kim Brown, 40, of Augusta, pled guilty to two counts of Aiding and Assisting in the Preparation and Filing of False Income Tax Returns. She faces up to three years in prison per count, supervised release, restitution, and financial penalties.

According to her plea agreement, Kim Brown operated her ghost tax business from her home. Like Allen Brown, she failed to identify herself as a paid preparer, fabricated income and deductions, charged clients a percentage of the refund, and did not review or provide copies of the returns before filing them.

Kim Brown and another individual prepared 22 false returns that led to $541,912 in fraudulent refunds from the U.S. Treasury.

The cases were investigated by the Internal Revenue Service Criminal Investigation Division and are being prosecuted by Assistant U.S. Attorney George J.C. Jacobs III.