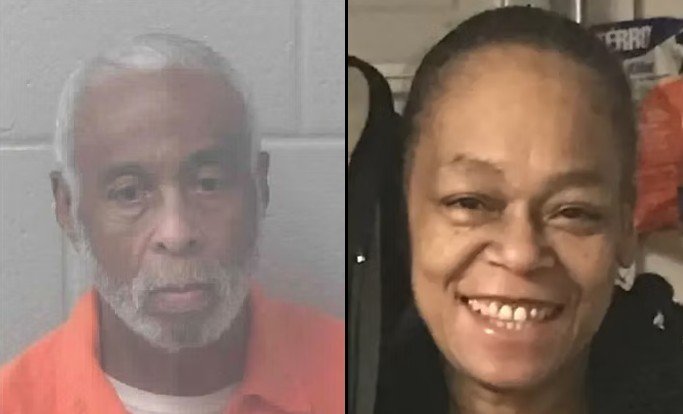

Atlanta Man Indicted for $3 Million CARES Act Fraud Scheme

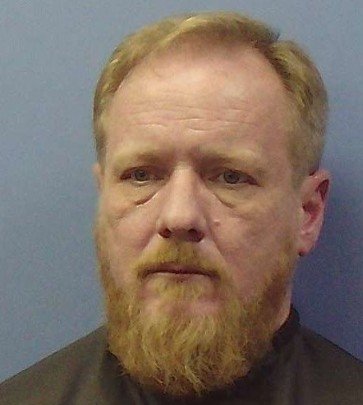

Ian Patrick Jackson, 37, of Atlanta, appeared before U.S. Magistrate Judge Regina D. Cannon today following his arrest on federal charges related to a scheme that allegedly defrauded the CARES Act of over $3 million. Jackson was indicted by a federal grand jury on May 6, 2025, facing charges of conspiracy to commit bank fraud, bank fraud, wire fraud, and money laundering.

“Jackson’s arrest caps a lengthy investigation that involved multiple defendants and more than $3 million in stolen funds intended to help struggling Americans during a national health crisis,” said U.S. Attorney Theodore S. Hertzberg. “These charges demonstrate our office’s commitment to collaborate closely with our law enforcement partners to prosecute fraudsters who pilfered CARES Act funds.”

Matthew R. Galeotti, Head of the Justice Department’s Criminal Division, added, “Ian Jackson took advantage of government programs meant to support American businesses struggling during a national emergency and world-wide pandemic. Today’s charges reveal that Jackson was the mastermind behind numerous schemes, utilizing a variety of fraudulent tools and techniques, to lie to the SBA. The Criminal Division will continue to investigate and prosecute those responsible for stealing taxpayers’ money during a crisis.”

According to U.S. Attorney Hertzberg and information presented in court, Ian Patrick Jackson allegedly conspired with another Atlanta man to solicit, recruit, and direct at least nine business owners to submit fraudulent Paycheck Protection Program (PPP) loan applications using fabricated tax documents. Jackson and his co-conspirator allegedly instructed the business owners to falsely claim that each business employed 16 individuals and paid monthly wages of $120,000. Each of these nine businesses subsequently received $300,000 in PPP funds. After receiving the funds, the business owners allegedly wrote “payroll” checks to individuals who did not work for their businesses, then either kept the money or gave it to a co-conspirator, who in turn provided a share to Jackson.

In addition to his alleged role in the conspiracy, Jackson is also charged in connection with three other schemes to submit fraudulent PPP or Economic Injury Disaster Loan (EIDL) applications. He allegedly:

- Applied for a fraudulent $237,500 PPP loan using fabricated tax forms and a doctored bank statement.

- Used a forged Georgia driver’s license to fraudulently apply for approximately $100,000 in EIDL and PPP loans using false revenue statements.

- Fraudulently obtained a $240,035 PPP loan and $125,000 in EIDL loans and grants.

All these loans were funded. Jackson allegedly spent the PPP and EIDL loan proceeds on checks made payable to fictitious individuals and on personal expenses, including restaurant dining, spa services, phone and credit card payments, a vacation in Aruba, and cash withdrawals.

Jackson is charged with one count of conspiracy to commit bank fraud, two counts of bank fraud, two counts of wire fraud, and two counts of money laundering. If convicted, he faces a maximum penalty of 30 years in prison on the conspiracy and bank fraud counts, and 20 years in prison for the wire fraud and money laundering counts. The Court will consider the United States Sentencing Guidelines, which are not binding, in determining the actual sentence.

The case is being investigated by the Small Business Administration – Office of the Inspector General and the Federal Bureau of Investigation. Special Assistant United States Attorney Diane C. Schulman and Department of Justice Criminal Division Trial Attorney Matthew Reilly are prosecuting the case, with assistance from former Assistant United States Attorney Christopher J. Huber.

Members of the public are reminded that an indictment contains only charges, and the defendant is presumed innocent until proven guilty beyond a reasonable doubt at trial.