Former SBA Officer Pleads Guilty to Fraudulently Approving Over $550,000 in COVID-19 Relief Loans

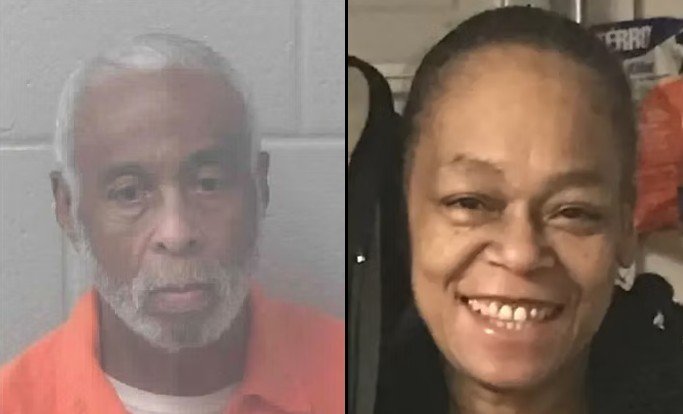

Rena Barrett, 45, of Covington, Georgia, a former Small Business Administration (SBA) loan officer, pled guilty on August 11, 2025, to making false statements to the SBA in connection with applications for more than $550,000 in fraudulent COVID-19 Economic Injury Disaster Loans (EIDL).

Barrett, who joined the SBA in October 2020, submitted a fraudulent EIDL application for $170,000 in May 2021. After the loan was initially declined, she approved it herself in July 2021, along with other loans submitted by her or her relatives. Barrett ultimately received nearly half of the funds she sought and resigned after her misconduct was discovered.

U.S. Attorney Theodore S. Hertzberg said, “It is intolerable that Barrett—who was entrusted to process loans for desperate small businesses—placed her personal greed ahead of doing her job honestly.” SBA Inspector General Amaleka McCall-Brathwaite added that the agency is committed to protecting taxpayer dollars and holding accountable those who exploit relief programs.

Barrett is scheduled to be sentenced on November 12, 2025. In a related case, Sheena Thompson, 49, of Conyers, Georgia, pled guilty to attempting to obtain more than $150,000 in fraudulent EIDL loans and will be sentenced on August 28, 2025. Separately, Detra Lewis, 40, of Atlanta, pled guilty to making false statements on a Paycheck Protection Program loan application and is scheduled for sentencing on November 14, 2025.

The investigations were conducted by the SBA Office of Inspector General, Homeland Security Investigations, and the FBI. Assistant U.S. Attorney Alex R. Sistla is prosecuting the cases.