Atlanta Financial Center Fraudster Sentenced to Over 7 Years in Prison

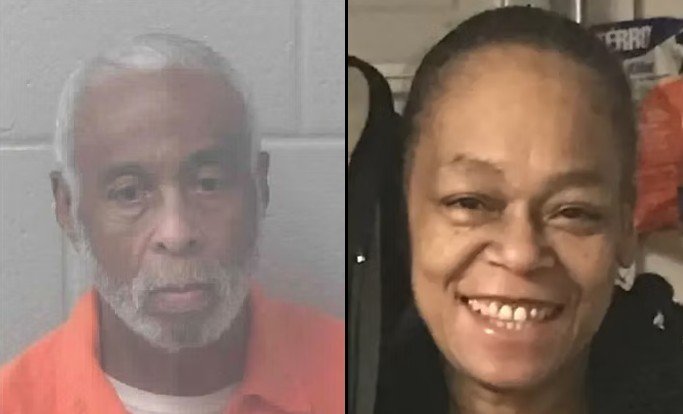

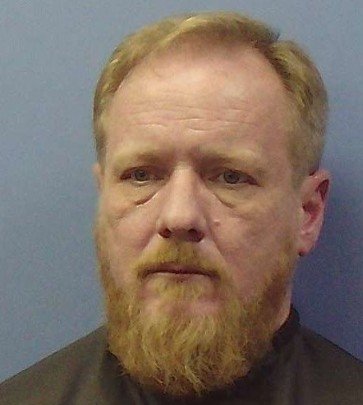

Elchonon (Elie) Schwartz, 46, of New York, New York, has been sentenced to 87 months in prison and ordered to pay over $45 million in restitution for a massive wire fraud scheme that defrauded more than 800 investors of approximately $62.8 million. The funds, including about $54 million earmarked for the Atlanta Financial Center, a planned commercial real estate complex, were instead diverted by Schwartz for his personal use and luxury purchases.

U.S. Attorney Theodore S. Hertzberg condemned Schwartz’s actions, stating, “Schwartz’s greed was boundless. He callously abused the trust of hundreds of investors to line his own bank accounts, purchase expensive watches, and buy additional luxury items. Schwartz’s sentence reflects our office’s commitment to hold fraudsters accountable for exploiting investors who innocently rely on their false representations.”

Paul Brown, Special Agent in Charge of FBI Atlanta, added, “This sentencing underscores that those who exploit the trust of investors for personal gain will be held accountable. Mr. Schwartz’s actions caused significant financial harm to hundreds of individuals, and hopefully today’s outcome delivers a measure of justice for the victims.”

According to information presented in court, beginning in May 2022, Elie Schwartz orchestrated a scheme to defraud commercial real estate investors through the crowdfunding investment website, CrowdStreet Marketplace. Schwartz raised nearly $63 million from hundreds of investors, with approximately $54 million designated for the Atlanta Financial Center and another $9 million for a mixed-use building in Miami Beach, Florida. Investors were assured that their funds would be held in segregated bank accounts, not commingled, and used exclusively for the specified property investments.

However, contrary to these representations, Schwartz misappropriated and converted substantially all the investor funds into his personal bank account, personal brokerage account, and accounts for unrelated commercial real estate investments he controlled. He used the stolen money to purchase luxury watches, invest in stocks and options, and cover payroll expenses for his unrelated businesses. In mid-July 2023, the two corporate entities Schwartz formed to receive funds from CrowdStreet investors filed for bankruptcy.

On May 19, 2025, U.S. District Judge Steven D. Grimberg sentenced Schwartz after he pleaded guilty to one count of wire fraud on February 12, 2025. In addition to the prison term, Schwartz will serve three years of supervised release.

The case was investigated by the Federal Bureau of Investigation, with valuable assistance from the Securities and Exchange Commission’s Division of Enforcement. Assistant U.S. Attorney Kelly K. Connors and Trial Attorney Matthew F. Sullivan of the Criminal Division’s Fraud Section prosecuted the case, with substantial assistance from former Assistant U.S. Attorneys David O’Neal and Christopher Huber.