Bar and Restaurant Owner in Georgia Receives Prison Sentence for Tax Evasion

A Georgia man was sentenced today to 24 months in prison for evading taxes in connection with his ownership of multiple bars and a restaurant in Georgia, as well as beer sales at a music festival.

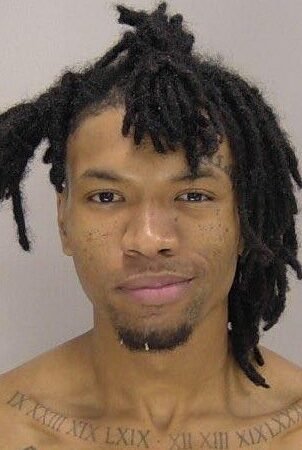

According to court documents and statements made in court, for the past two decades, Eugene R. Britt III, also known as Trey Britt, of Milledgeville, Georgia, engaged in a scheme to evade taxes owed to the IRS on income from bars and a restaurant he and others co-owned. Britt and others concealed their ownership interest by causing each establishment to be nominally owned by a single person. Britt and the other true owners shared in the profits generated by the establishments by skimming cash and disbursing it amongst themselves without reporting the cash as income to the IRS. Additionally, Britt used a similar organizational structure in the sale of beer at a music festival in 2015 and did not report the cash he received from the businesses or the music festival on his personal income tax returns.

In addition to the term of imprisonment, U.S. District Judge J. Randal Hall of the Southern District of Georgia ordered Britt to serve three years of supervised release and to pay a $10,000 fine and $362,250 in restitution.

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Jill E. Steinberg for the Southern District of Georgia made the announcement.

IRS-Criminal Investigation and the FBI investigated the case.

Assistant Chief David Zisserson and Trial Attorney Casey S. Smith of the Tax Division and Assistant U.S. Attorney Tania Groover of the Southern District of Georgia prosecuted the case.